The Illusion of Nominal Gains

The past quarter-century has been shaped by unprecedented monetary expansion, with central banks flooding the financial system with liquidity. In the US, the Federal Reserve has expanded the supply of US dollars more than sixfold since 2000, and this liquidity has caused market momentum as well as making investors feel wealthier as a result of one of the longest bull markets in history.

However, when money itself is losing value, nominal gains tell an incomplete story. What appears to be wealth creation may simply reflect a weakening currency, and as purchasing power erodes, the true measure of performance shifts from asset price inflation to value preservation. This piece explores the how dollar's depreciation is forcing a change in how we measure real returns, with Bitcoin emerging as the modern sound money anchor.

The Roots of Dollar Erosion

Since WWII, the US dollar has served in the dual role of both national currency and world's reserve currency. This conferred an immense privilege, allowing the US to finance consumption and military power simultaneously by exporting dollars and importing goods, all while running chronic trade and budget deficits.

However, for decades cheap imports and sustained foreign demand for US Treasuries masked the steady erosion of the dollar's purchasing power both at home and abroad. This erosion, combined with the accumulation of public debt facilitated by chronic fiscal deficits, is the root cause of the persistent inflation. This problem has been exacerbated by the government’s repeated reliance on stimulus measures to ward off successive economic crises.

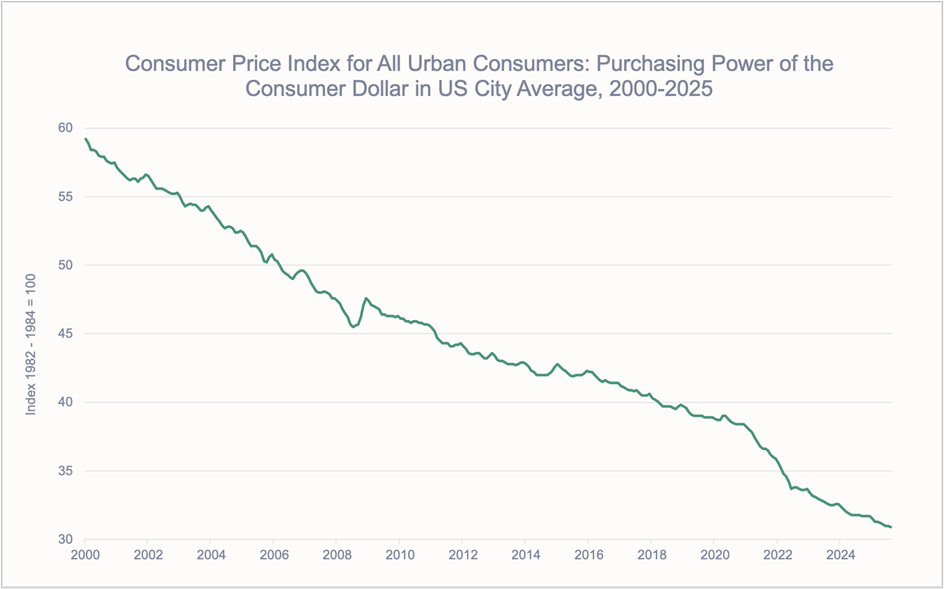

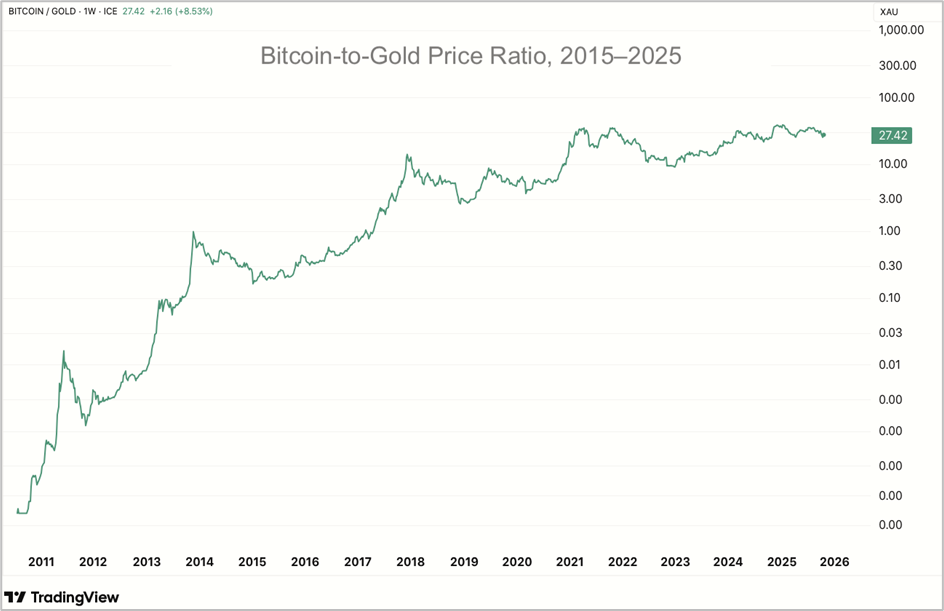

As of 2025, the US dollar has lost close to 40% of its purchasing power over the past 25 years (see Chart 1). Consequently, markets from broad indices to gold are at or near all-time nominal highs, continuing their secular bull trend from the pre-COVID era, despite comparatively elevated levels of macro issues and geopolitical stress.

Chart 1: Purchasing power of the US dollar, 2000–2025, based on the Consumer Price Index for All Urban Consumers (CPI-U). The index shows a steady decline in the dollar’s real value, reflecting the cumulative impact of inflation over the past quarter-century. Source: Board of Governors of the Federal Reserve System (US) via FRED, 3iQ

When assets are priced in weakening currency units, investors experience 'denominator blindness,' where rising nominal values appear as genuine gains even as the unit of account is simultaneously eroding.

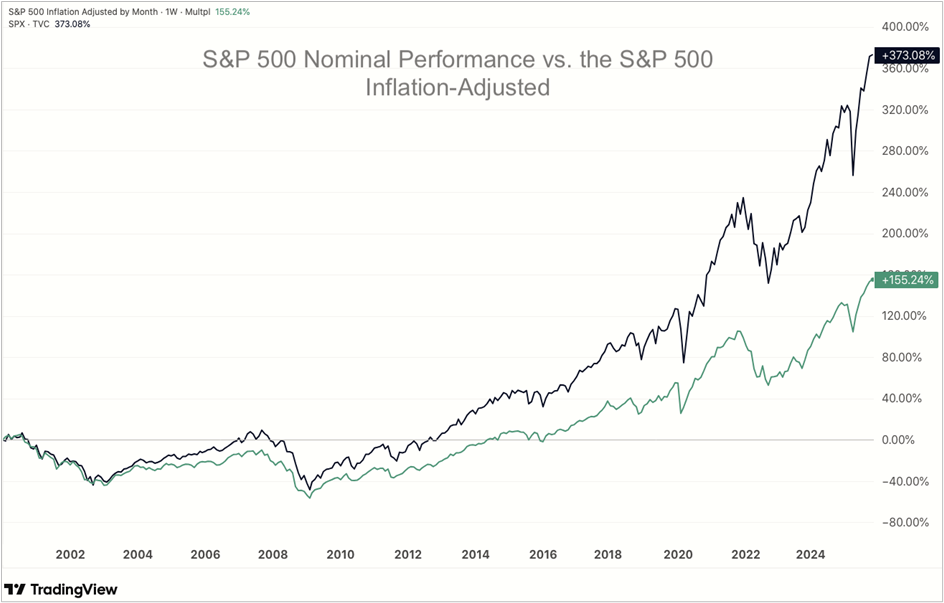

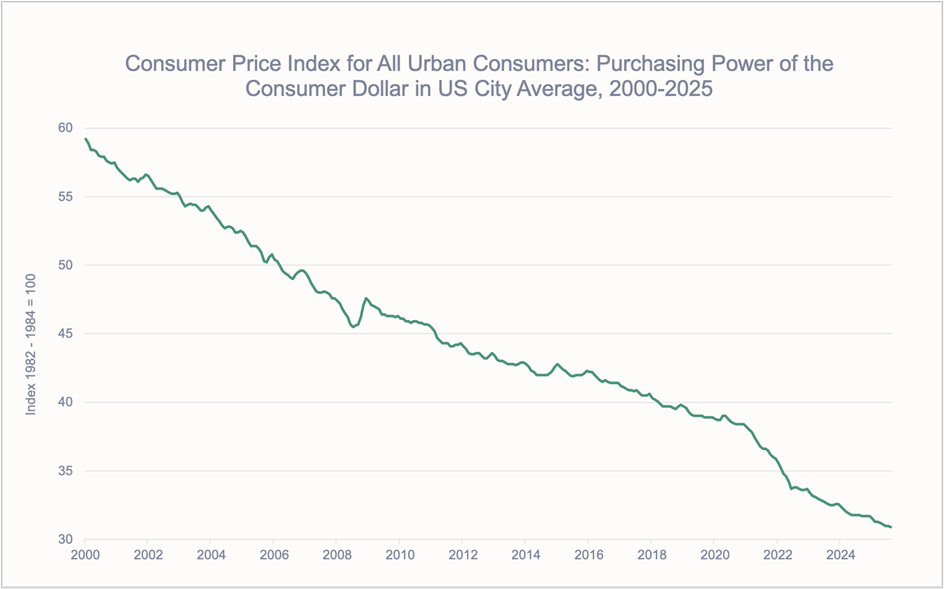

The divergence between the nominal and inflation-adjusted S&P 500 performance (Chart 2) underscores how much of the market’s long-term advance reflects monetary expansion rather than genuine economic value creation. While equities have roughly tripled in nominal terms since 2000, the true, inflation-adjusted gains are less than half that amount. The noticeable widening of this gap after 2020 directly corresponds with the surge in money supply during the pandemic era, providing clear evidence that liquidity-driven growth often conceals the underlying erosion of purchasing power.

Chart 2: S&P 500 nominal versus inflation-adjusted performance (adjusted monthly), 2000–2025. While the index has gained over 370% in nominal terms, real gains fall closer to 155% when adjusted for inflation. Source: TradingView, 3iQ

Measuring Value in Sound Money: From Gold to Bitcoin

Gold has historically provided a mechanism for correcting the distorted perception of returns caused by inflation by functioning as a stable denominator, preserving purchasing power across economic cycles and political regimes.

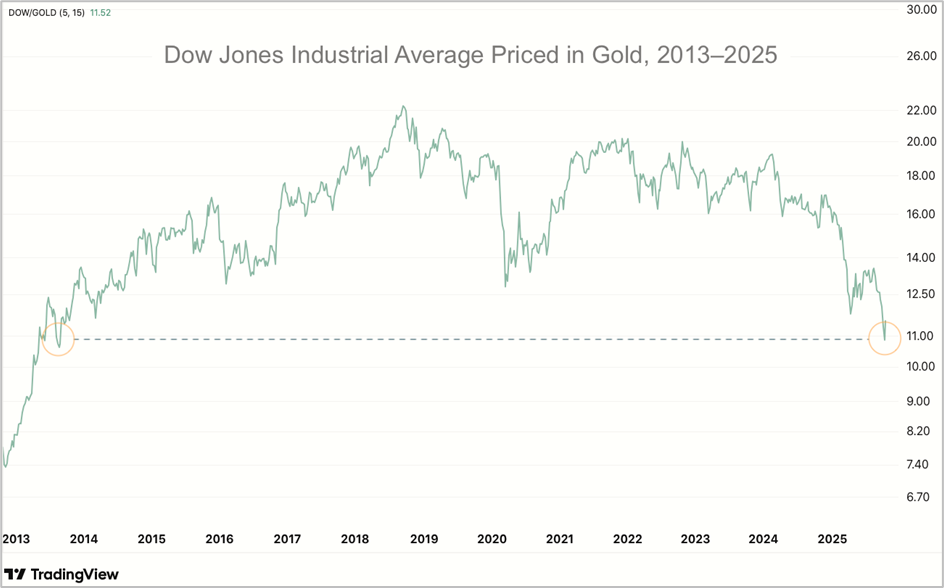

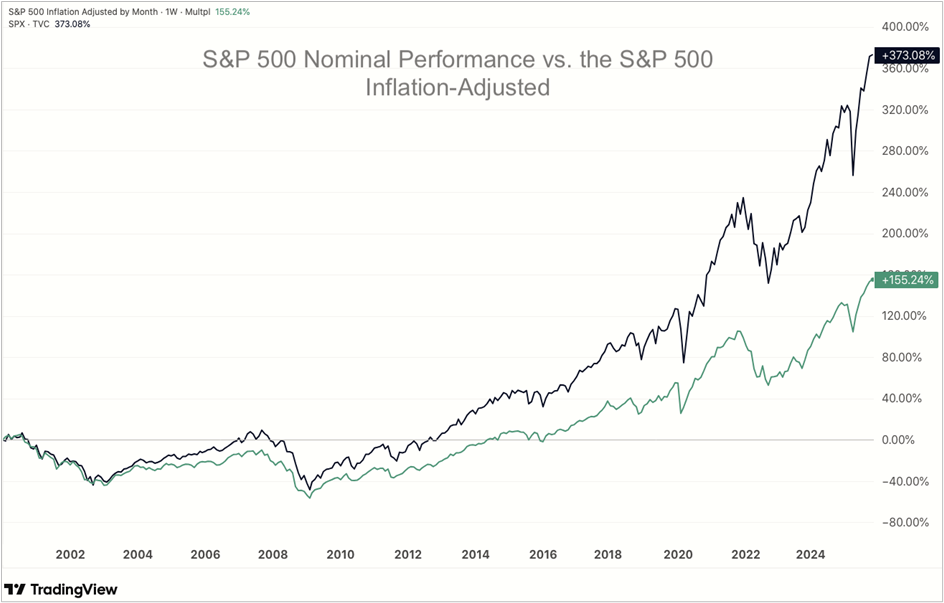

Despite setting record nominal highs, the gold-denominated value of equities has stagnated for over a decade see. This relationship is clearly demonstrated by the Dow/Gold Ratio, which is the number of ounces of gold required to buy one share of the Dow Jones Industrial Average. As of October 2025, the Dow/Gold Ratio has dropped back to levels last seen in August 2013 (Chart 3).

Chart 3: Dow Jones Industrial Average priced in gold, 2013–2025. The ratio has fallen back to levels last seen in March 2014, highlighting how nominal equity gains have eroded when measured against a stable store of value. Source: TradingView, 3iQ

Gold thus provides the longest-running mirror for monetary distortion and is a time-tested unit of account against which the erosion of sovereign currencies can be measured.

From Gold to Code: Bitcoin’s Emergence as a Monetary Benchmark

While Gold has long served as the reference point for real value, as the economy digitised and monetary intervention accelerated, Bitcoin has emerged as a sound money alternative. It extends the logic of scarcity into the digital realm, and was designed to be a finite and frictionless form of money, able to replicate gold’s stability without its physical constraints and sovereign underpinnings.

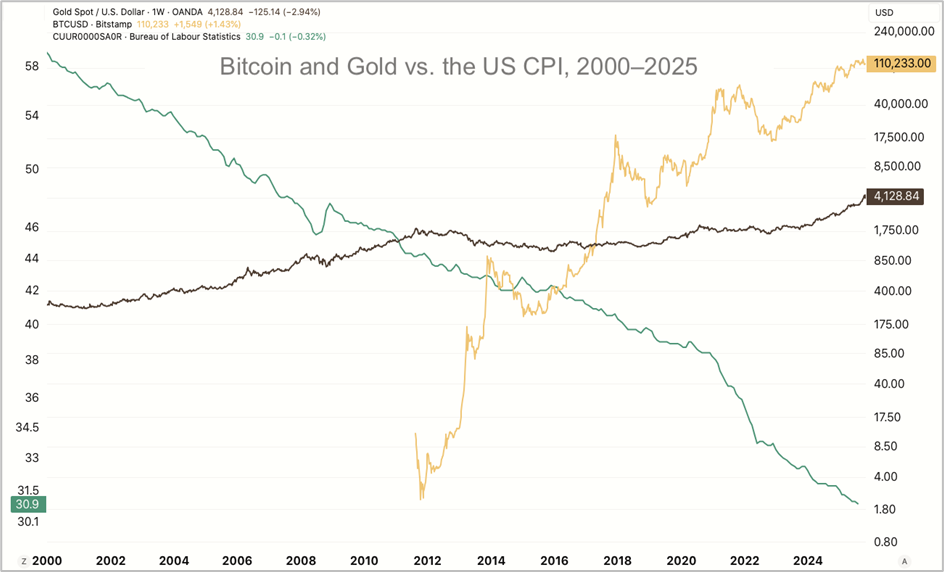

Indeed, the last twenty-five years have effectively turned global markets into a referendum on monetary credibility, a trend that becomes unmistakable when the three main stores of value are compared side by side.

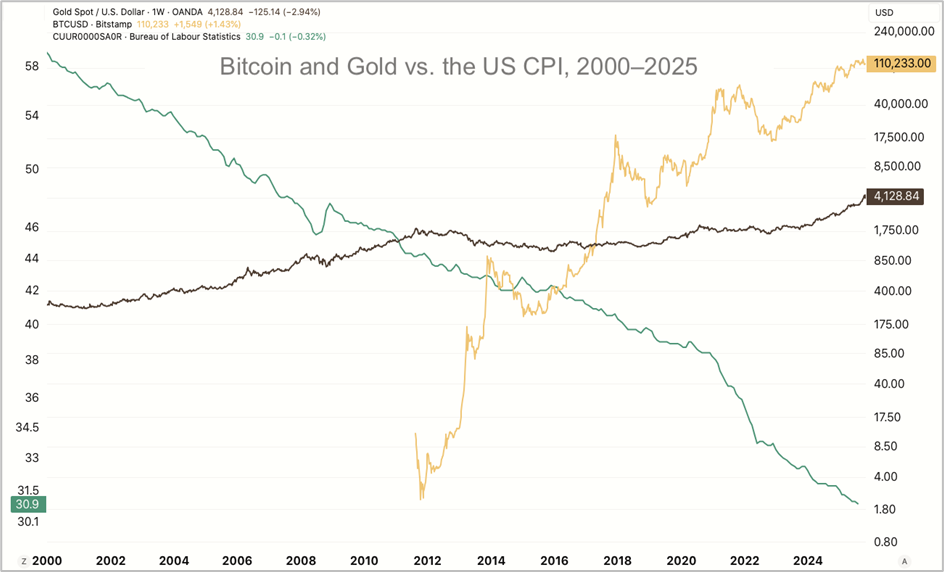

Chart 4: Bitcoin, gold, and the U.S. Consumer Price Index for All Urban Consumers (CPI-U), 2000–2025. As the CPI (green) has trended higher, indicating a steady decline in purchasing power, both gold (black) and Bitcoin (yellow) have appreciated sharply, reflecting investor demand for assets that maintain real value. Source: TradingView, 3iQ

The divergence is striking. Despite gold’s noticeable bullish moves, it has maintained a steady real value, while Bitcoin's exponential rise reflects the world's ongoing dependence on monetary expansion to support nominal asset prices. This is driving a flight to scarce, non-sovereign stores of value fit for the digital world.

By stark contrast, the purchasing power of the dollar has continued to erode, reinforcing why investors increasingly compare performance against hard, rather than nominal, benchmarks.

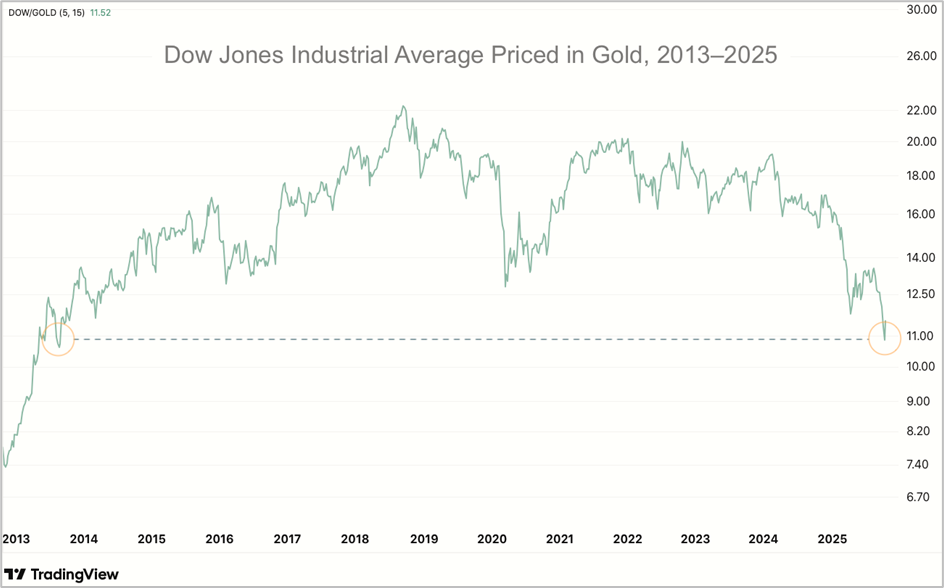

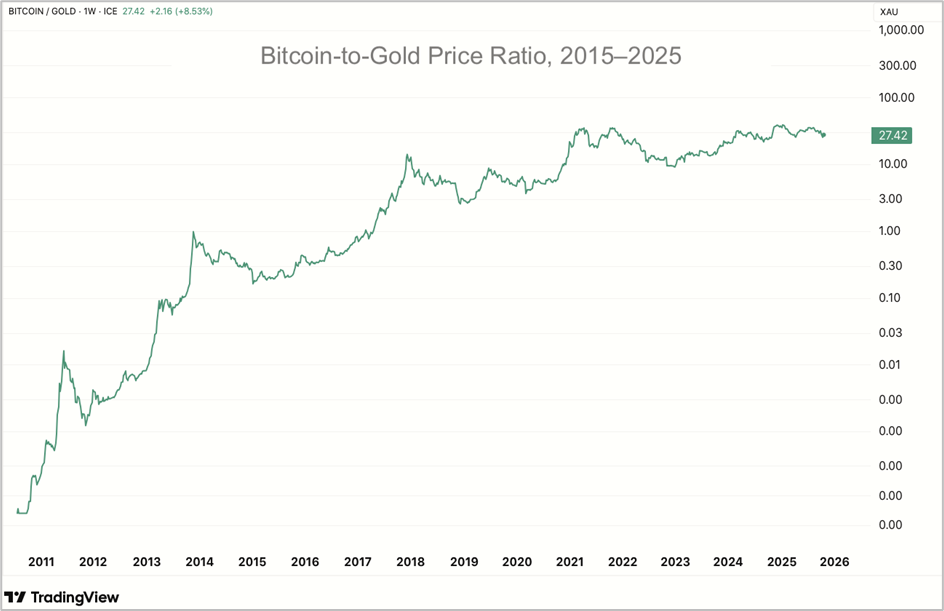

Bitcoin’s fixed supply of 21 million coins and its independence from fiscal or monetary discretion make it a natural successor to gold’s role as a sound monetary anchor. Charting Bitcoin against gold (Chart 5) highlights how the digital asset has outperformed its physical predecessor in nearly every cycle, evolving from speculative trade to strategic allocation within the same store-of-value continuum.

Chart 5: Bitcoin-to-gold price ratio, 2015–2025. Each major cycle has seen Bitcoin gain relative value versus gold, reinforcing its position as a digital counterpart to the traditional store of value. Source: TradingView, 3iQ

Bitcoin: A New Denominator for the 21st Century

What gold achieved through natural scarcity, Bitcoin is now replicating through code. Together they represent two credible anchors of value in an environment where monetary expansion continues to distort asset valuations. This evolution is reshaping the definition of hard assets and the role they play within diversified portfolios.

As purchasing power continues to erode through government and central bank policy interventions, investors are shifting from what generates return to what preserves real value. Gold will continue to serve as the traditional reference point, but Bitcoin’s acceptance as its digital counterpart is strongly reflected by its continual adoption as the ‘gold standard’ digital asset across the mainstream of traditional finance.