The hedge fund industry has entered a prolonged period of diminishing returns. Once the premier vehicles for uncorrelated alpha, hedge funds are now constrained by regulatory burdens, compressed fees, and overcrowded strategies. Asset managers are increasingly sceptical, questioning whether the model still offers the performance edge it once did.

By contrast, crypto hedge funds are operating in a younger and less efficient market environment. 24/7 liquidity, structural volatility, and radical transparency from on-chain data, have produced returns that stand out against traditional benchmarks. Importantly, these results are being generated through familiar hedge fund playbooks applied to digital markets where inefficiencies remain abundant.

This article explores the shift from the declining alpha of legacy hedge funds to the emergence of crypto hedge funds as a new arena for active management.

Section A: The Evolution of Hedge Funds: From Alpha to Compression

The hedge fund industry’s history is defined by its ability to adapt. From its early beginnings in the mid-20th century, hedge funds were designed to pursue uncorrelated returns through flexible, often unconventional strategies. In the decades leading up to the global financial crisis, managers were able to exploit inefficiencies in equities, currencies, and commodities, thereby consistently producing alpha that could not be replicated by traditional long-only mandates.

That dynamic shifted after 2008 when post-crisis reforms such as the Dodd-Frank Act in the US and the implementation of Basel III capital standards globally imposed stricter oversight and reporting obligations as well as higher capital requirements. These measures improved systemic resilience but limited the flexibility of hedge fund managers to deploy, leverage or execute certain strategies.

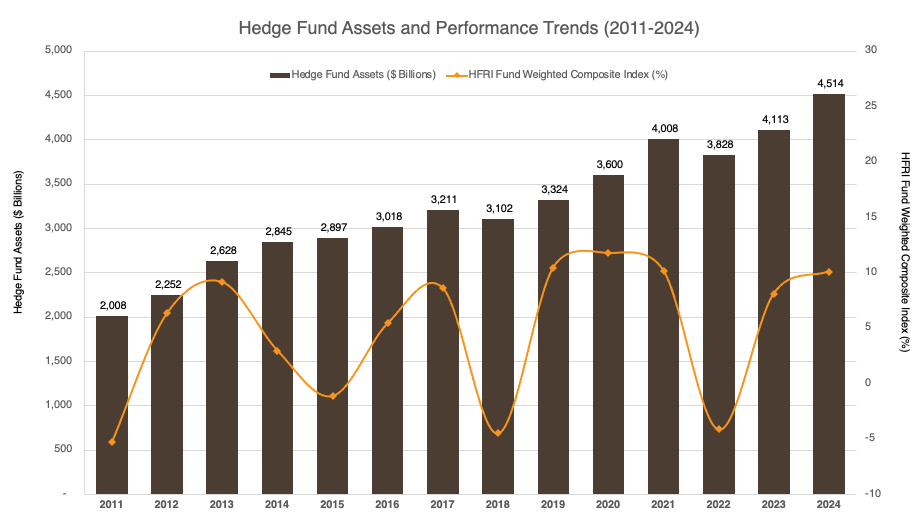

At the same time, the industry’s growth created a problem of its own: overcrowding. By 2024 hedge fund assets under management exceeded $4.5 trillion globally but this growth has not been matched by performance.

Steady growth in hedge fund assets contrasts with muted, volatile returns — underscoring the pressures that have driven institutions to seek new sources of alpha. Source: Hedge Fund Research (HFR), ETFGI, 3iQ

Despite registering somewhat of a rebound in 2024 with a gain of 9.75% compared with 4.82% in 2023, the HFRI Fund Weighted Composite Index posted an annualized return of 5.26% over the last decade. This compares to 12.2% for the S&P 500, reflecting how alpha has compressed, leaving allocators questioning the rationale for premium fee structures.

Fees have also declined, with the average fee structure having significantly departed from the "2 and 20" industry standard of yesteryear. Industry sources indicate that management fees are now typically 1.3–1.5%, while the average performance fee is 16.5%, suggesting a broader trend of fee compression.

These dynamics have led to increasing allocator scepticism. While hedge funds remain important as diversifiers, their ability to consistently deliver differentiated returns has waned. For investors, the question is less whether hedge funds belong in portfolios, and more where the next frontier of hedge fund–style alpha might be found.

Section B: Where the Talent Is Going

Talent has always been the decisive factor in hedge fund performance, and its migration is one of the clearest signals that digital assets are becoming a new frontier for the industry. Portfolio managers from macro, equity, and FX desks at firms such as Goldman Sachs, Citadel, and Millennium have taken senior roles in crypto-focused strategies, drawn by the ability to apply sophisticated playbooks in markets that remain less efficient and more volatile than traditional asset classes.

The lower barriers to entry in crypto have reinforced this trend. Launching a traditional hedge fund typically requires prime brokerage agreements, large seed commitments, and extensive infrastructure. By contrast, digital asset managers can operate with leaner teams and smaller footprints, enabling them to experiment with strategies ranging from basis arbitrage to momentum-driven trading. This agility has given rise to a diverse ecosystem of emerging managers, many of whom combine hedge fund discipline with crypto-native insights.

The shift is also reflected in 3iQ’s own trajectory. In 2025, the firm appointed Tommaso Mancuso as Global Head of Investments, bringing over two decades of investment management experience across hedge funds, multi-asset strategies and alternative investments. His move into digital assets underscores how professionals from established hedge fund and asset management backgrounds are increasingly drawn to the sector. More broadly, industry surveys suggest that more than 40% of digital-asset hedge funds are founded or staffed by professionals with prior traditional finance experience (PwC/AIMA, 2024), highlighting a structural reallocation of expertise.

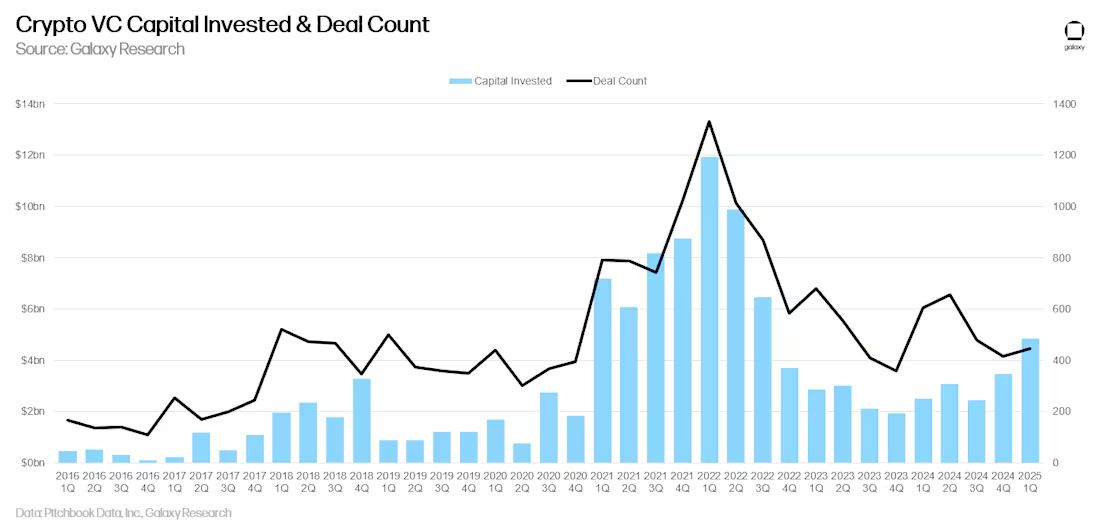

Capital trends further reinforce a directional shift in the market. Global crypto venture funding fell 74% year-over-year in 2023, from $26.6 billion to under $7 billion, according to Crunchbase. Although activity rebounded by 28% in 2024, volumes remain far below the previous bull market. With fewer opportunities in early-stage investing, capital and managerial focus are tilting toward liquid hedge fund strategies, where returns can be realized over shorter horizons.

Crypto venture capital investment and deal activity have fluctuated sharply, with recent years showing a decline from earlier peaks. Source: Galaxy.com

For allocators, these talent flows matter. They show that digital assets are no longer a peripheral experiment, but a deliberate career choice for professionals seeking environments where active skill is rewarded. As with earlier phases of the hedge fund industry, where talent preceded capital, this migration serves as a leading indicator of credibility and growth.

Section C: Market Structure Advantages of Crypto for Active Managers

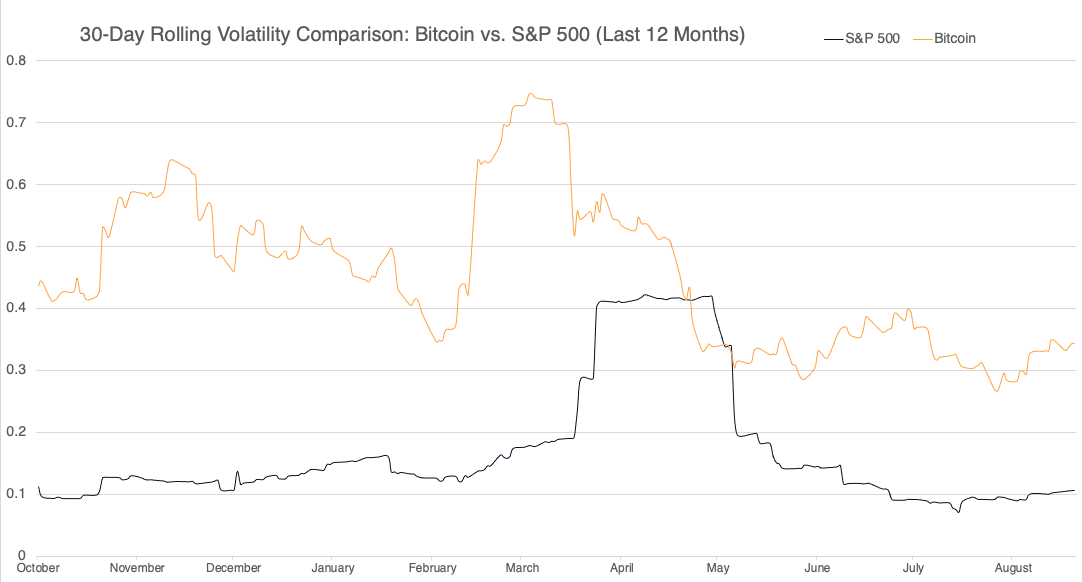

Crypto markets possess characteristics that make them unusually fertile ground for hedge fund strategies, with volatility being the most visible. Although Bitcoin's annualized volatility has dropped to 38% from a peak of nearly 200% over a decade ago, it still remains significantly higher than traditional assets like the S&P 500, which had an annualized volatility of 15.3% in 2024. This variability supports a wide spectrum of hedge fund strategies, from trend-following and directional bets to market-neutral arbitrage.

Bitcoin’s volatility has consistently exceeded that of the S&P 500 over the past year, reflecting the higher-risk, higher-opportunity environment of digital assets. Source: 3iQ (data sourced from MarketWatch)

Dispersion across tokens amplifies the opportunity set, with mid- and small-cap assets still prone to double- and triple-digit moves within a single year. For active managers, such dispersion represents raw material for alpha that is largely absent in traditional equity markets.

Beyond capital flows, the distinct liquidity dynamics of the crypto market further differentiate its trading environment, offering unique opportunities for sophisticated strategies. Trading is continuous across global venues, operating 24 hours a day, seven days a week. For funds relying on rapid execution for intraday arbitrage, cross-exchange spreads, or basis trades in derivatives, the constant turnover expands the set of viable trades.

ETFs have added depth to this liquidity profile: daily trading volumes in US spot Bitcoin ETFs now average $2.8 billion, equivalent to roughly two-thirds of Binance’s daily spot volume (CryptoQuant, 2025). For allocators, this underscores that institutional capital itself is now reinforcing liquidity conditions.

Another advantage is information transparency. On-chain data offers visibility with no equivalent in traditional markets. Managers can monitor wallet flows, token issuance, and liquidity dynamics in real time, generating signals that sharpen decision-making. While equity investors are limited to quarterly filings and delayed disclosures, crypto funds can model strategies from immediate, public transaction data to sharpen signals and refine risk models in ways unavailable in other asset classes.

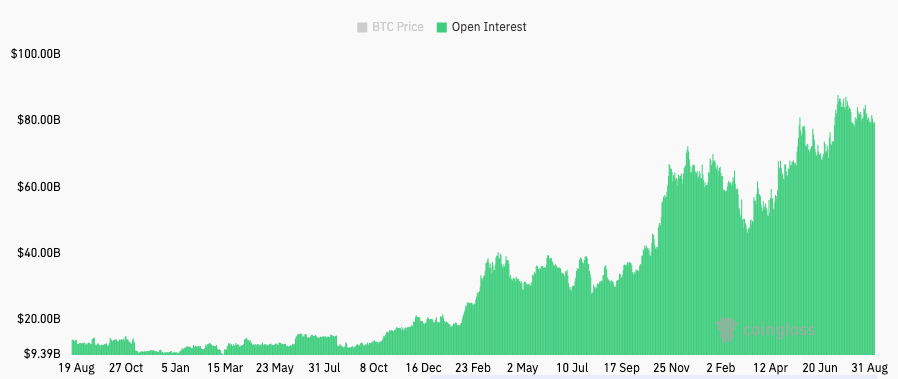

Building on this foundation of transparency, the derivatives infrastructure has also matured rapidly. Perpetual swaps and listed options are now deeply traded, with notional open interest in Bitcoin futures averaging $13 billion in late 2024 (CoinGlass, 2025). Combined with DeFi lending markets, these tools allow managers to construct market-neutral exposures, capture arbitrage spreads, and manage risk with precision.

Caption: Open interest in Bitcoin derivatives has expanded significantly reflecting increasing institutional participation and providing hedge funds with more sophisticated tools to implement strategies Source: CoinGlass

Taken together, volatility, continuous liquidity, information transparency, and a robust derivatives complex converge to create conditions uniquely favourable for hedge funds. For allocators, these are not theoretical advantages but structural features of the market that expand the opportunity set for active management.

Section D: Performance Evidence: Who’s Outperforming?

Strong performance has driven significant inflows into crypto hedge funds. PwC’s 2024 Global Crypto Hedge Fund Report shows that dedicated crypto hedge fund AUM grew by roughly 15% year-on-year, even as net inflows across the traditional hedge fund industry remained broadly flat. While this growth is notable, it's important to recognize the difference in scale: 78% of crypto funds manage less than $50 million in assets, whereas only 38% of traditional hedge funds fall into this category. This disparity shows that traditional hedge funds have a much stronger presence in larger asset brackets.

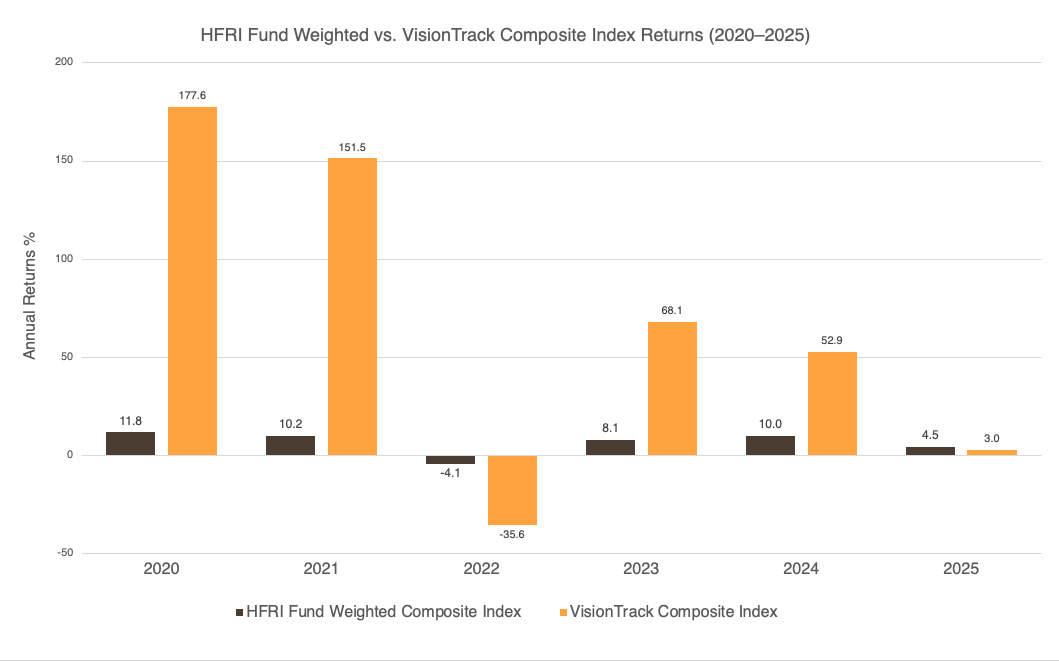

The clearest way to assess crypto hedge funds is by their results, and index data shows they have consistently outpaced their traditional peers. For example, the VisionTrack Crypto Hedge Fund Composite Index returned +68.1% in 2023 and +52.9% in 2024, compared with +8.1% and +10.0% respectively for the HFRI Fund Weighted Composite. Even when adjusted for higher volatility, Sharpe ratios across many crypto strategies remain competitive with, and in some cases exceed, those of equity long/short and macro funds.

Annual returns of crypto hedge funds, as tracked by the VisionTrack Composite Index, compared with the HFRI Fund Weighted Composite Index. Note: The data is up to November 2025 and does not include December data. Source: Galaxy, HFR, 3iQ

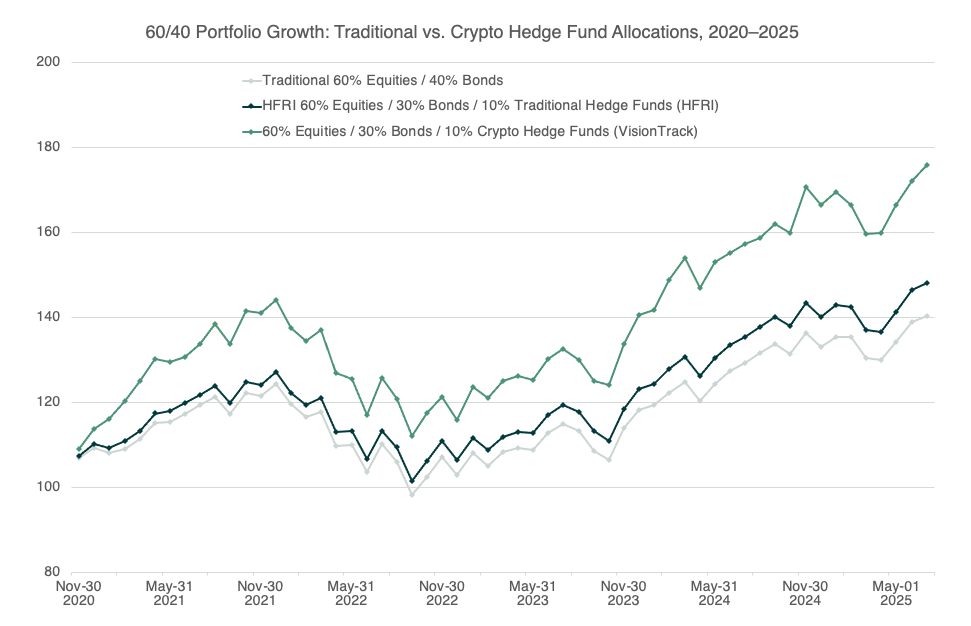

Our analysis demonstrates how the strategic allocation to alternative assets, specifically crypto and traditional hedge funds, can significantly enhance the risk-adjusted returns of a standard 60/40 portfolio.

Chart shows cumulative growth of a $100 investment in a 60/40 portfolio versus allocations with 10% hedge funds. Traditional hedge funds (HFRI) offer modest improvement, while crypto hedge funds (VisionTrack) deliver stronger performance (Equities are represented by the S&P 500 (SPX) and bonds by the iShares Core U.S. Aggregate Bond ETF (AGG)). Source: 3iQ, Galaxy/VisionTrack, Hedge Fund Research (HFR), SPX & AGG data sourced from MarketWatch.

Replacing 10% of equities in a 60/40 with traditional hedge funds (HFRI) improved return and Sharpe modestly. By contrast, replacing 10% with crypto hedge funds (VisionTrack) delivered a meaningfully larger uplift in return and Sharpe, with only a moderate increase in volatility. This indicates that crypto hedge funds behave like a distinct building block that can improve portfolio efficiency more than a traditional HF sleeve in this window.

|

Portfolio |

Annualized Return |

Annualized Volatility |

Sharpe (rf=0%) |

|

60/40 |

7.40% |

11.47% |

0.68 |

|

60/30/10 HFRI |

8.62% |

11.44% |

0.78 |

|

60/30/10 VisionTrack |

12.62% |

13.41% |

0.96 |

Risk-adjusted metrics show that adding 10% to crypto hedge funds (VisionTrack) meaningfully improves portfolio efficiency compared with traditional hedge funds (HFRI). Source: 3iQ, data sourced from MarketWatch.

Dispersion is another notable feature of crypto hedge funds. Performance spreads between managers are far wider than in most traditional strategies, underscoring both the inefficiencies of digital markets and the importance of careful manager selection. For allocators, this dispersion represents risk but also the potential for differentiated alpha. Here, several high-profile managers attracted new allocations from family offices and specialist funds of funds, validating these strategies as credible vehicles for institutional-style capital.

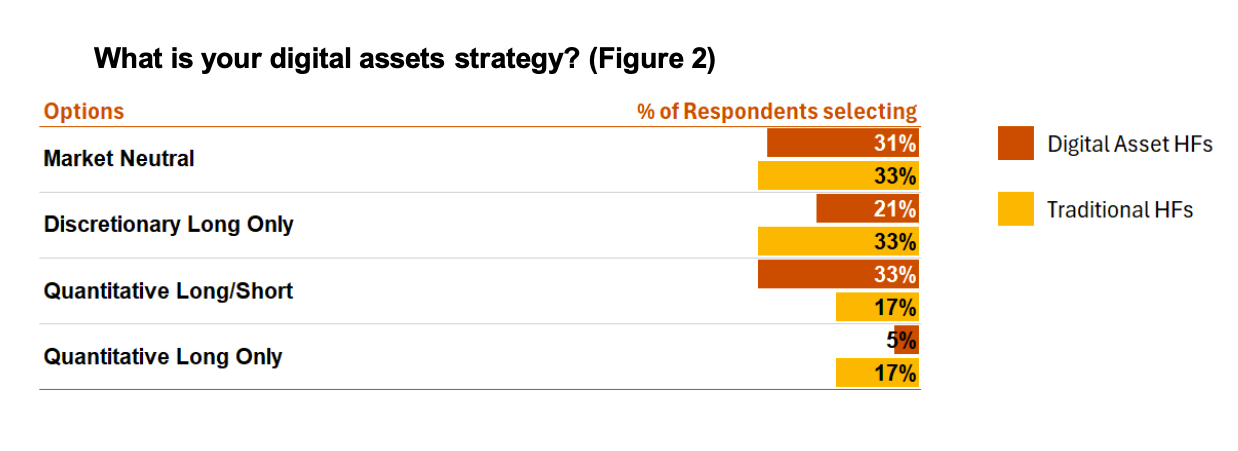

This diversity of strategies reinforces the variety of risk appetites and investment objectives within the crypto hedge fund community. For digital asset hedge funds, quantitative long/short (33%) and market neutral (31%) are the prevailing strategies. The popularity of the latter largely comes as a result of spot ETF basis trades. This balance illustrates that performance is not confined to speculative bets but reflects a broad application of time-tested hedge fund frameworks in digital markets.

Breakdown of strategy preferences among digital asset hedge funds compared with traditional hedge funds. Source: PwC/AIMA 2024 Global Crypto Hedge Fund Report

From an institutional perspective, the takeaway is clear. Crypto hedge funds are not simply volatile vehicles riding price cycles; they are a professionally managed, diverse segment of the hedge fund universe. With competitive performance metrics, low correlations to traditional markets, and proven strategy breadth, they represent a credible new frontier for alpha generation.

Section E: The Institutional Catch-Up Phase

Early allocations to crypto hedge funds have largely come from family offices and high-net-worth individuals, while pensions and endowments remain cautious. This pattern mirrors the early development of traditional hedge funds, when smaller, more agile allocators moved first, and larger institutions only followed once governance standards matured.

Institutional engagement, however, is beginning to shift. According to the PwC/AIMA survey, 47% of traditional hedge funds now invest in digital assets, up from 37% in 2022 and 29% in 2023. These allocations are typically modest, yet they signal a growing willingness to integrate crypto strategies into broader alternative asset portfolios. Consultants and outsourced CIOs are also expanding coverage, embedding digital assets into their evaluation frameworks.

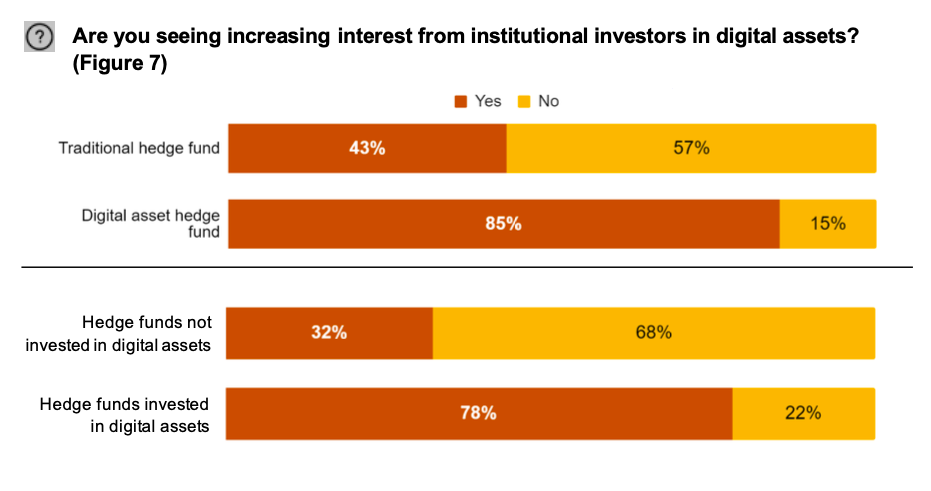

Digital asset hedge funds report growing institutional interest compared to traditional hedge funds, with those HFs already investing in digital assets more likely to perceive rising institutional demand. Source: PwC/AIMA 2024 Global Crypto Hedge Fund Report

Furthermore, the survey results suggest that institutional interest in digital assets is expanding, albeit at varying levels across market participants. Among hedge funds already invested in digital assets, 78% report an increase in institutional investor interest. However, for those without crypto exposure, only 1 in 3 have seen a similar uptick. This suggests that institutional investors prefer to explore digital assets with funds that have pre-existing experience in the asset class.

For institutions, the conversation always comes back to operational due diligence. Custody, fund administration, and compliance remain the core areas of scrutiny. Yet there has been clear progress: by late 2024, more than 80% of crypto hedge funds used third-party custodians, and a growing share had brought in independent administrators. These improvements do not remove every concern, but they bring the sector much closer to institutional standards, and make it easier for gatekeepers to approve new allocations.

At the same time, headwinds persist, and regulatory clarity is uneven across jurisdictions. Banking relationships can still pose challenges for some funds. These frictions slow the pace of adoption but do not alter the underlying trajectory. The combination of strong performance, credible talent, and improving infrastructure means that institutional allocators are increasingly compelled to consider crypto hedge funds as part of their opportunity set.

Conclusion: The Next Phase of Hedge Fund Alpha

The hedge fund industry has always thrived where volatility and inefficiencies are greatest, and today those conditions exist in digital assets. Crypto hedge funds are moving rapidly from the margins of finance to the mainstream of institutional alternatives. For asset managers and allocators, several forward-looking themes will define the next phase:

- Where alpha remains abundant: Market inefficiencies continue to create wide performance dispersion, rewarding active skill.

- Where institutions are entering: Family offices have led, but consultants and hedge funds are now embedding digital assets into their frameworks.

- Where infrastructure is converging: Custody, administration, and compliance standards are aligning with traditional expectations.

- Where access is being simplified: Platforms such as 3iQ’s QMAP provide turnkey exposure, lowering the barriers to allocation.

These dynamics point to a market still in its early innings, and looking ahead, crypto hedge funds are positioned to play a pivotal role in portfolios seeking new sources of return. They offer not only the potential for compelling performance but also strategic value in diversification and resilience. As digital assets mature into a recognized asset class, active management through hedge funds may prove to be one of the most effective ways to unlock their potential.

Disclaimer:

This article is provided for educational and informational purposes only. It does not constitute financial, investment, legal, or regulatory advice and should not be construed as a recommendation to buy, sell, or hold any cryptocurrency or digital asset.